Business Insurance in and around Indianapolis

One of Indianapolis’s top choices for small business insurance.

Insure your business, intentionally

- Nora, IN

- Lapel, IN

- 46032, IN

- 46033, IN

- 46074, IN

- 46030, IN

- 46031, IN

- Atlanta, IN

- Fishers, IN, 46037

- 46038, IN

- 46040, IN

- Castleton, IN

- Oaklandon, IN

- Southport, IN

- Indiana, US

- McCordsville, IN

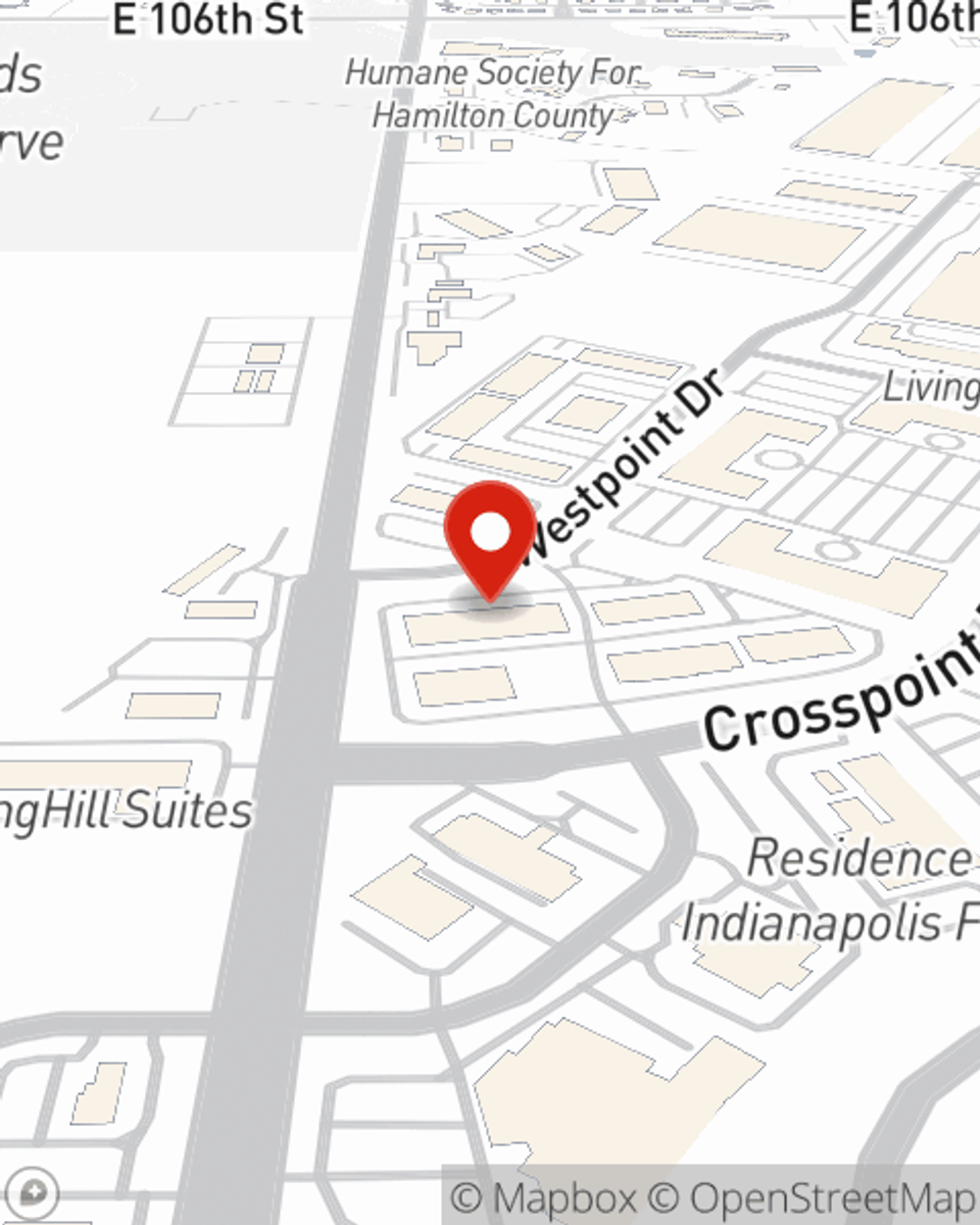

- Indianapolis, IN

- Carmel, IN

- Arcadia, IN

- Hamilton County, IN

- Marion County, IN

- Noblesville, IN

- Hancock County, IN

Coverage With State Farm Can Help Your Small Business.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like an employee gets hurt on your property.

One of Indianapolis’s top choices for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Beau Bradle can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Don’t let the unknown about your business stress you out! Visit State Farm agent Beau Bradle today, and see how you can meet your needs with State Farm small business insurance.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Beau Bradle

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.